Taxation & Compliance

Posted on Mar 10, 2025

For example- you've just finalised a high-ticket sale with a foreign client. You deliver the service, send the invoice, and wait anxiously for your payment. But what you receive is not a credit notification, but a call from your bank informing you, "Your payment is on hold because of an invalid purpose code.

This is where the majority of Indian exporters fall behind — the wrong RBI purpose code for their overseas transactions.

If you provide business, professional, or consultancy services to foreign clients, the P1006 purpose code is exactly for you.

However, most exporters either lack knowledge about it or use the wrong code and thus face payment delays, compliance problems, or increased tax implications.

In this guide, you'll discover:

What is Purpose Code P1006?

When to use it?

What if you choose the incorrect code?

How to make international payments hassle-free?

By the end of this blog, you will be a pro at using Purpose Code P1006 and never encounter unnecessary payment hiccups.

What is P1006 Purpose Code as per RBI?

Definition in Easy Language

The P1006 purpose code is a distinct classification brought into effect by the Reserve Bank of India (RBI) in the FEMA guidelines India. This purpose code comes into play when Indian exporters render business consultancy, professional services, technical services, or market research to foreign clients and receive payments in foreign currency.

It is, in effect, a tag that tells your bank and RBI why you are being paid. Using the appropriate purpose code ensures that:

Your payment goes through without hiccups.

Your income is tagged correctly for taxation.

You are following RBI and FEMA regulations.

If you provide professional services such as web design, content creation, IT solutions, marketing, or any advisory work to overseas clients — Purpose Code P1006 is your choice.

Why Does RBI Want to Know Purpose Code P1006?

The Reserve Bank of India (RBI) keeps a watch over all foreign remittances earned by Indian exporters to:

Monitor foreign exchange inflows.

Identify correct tax classification.

Block money laundering or misreporting of foreign income.

If you get your purpose code wrong, it can:

Hold up your payment while the bank confirms the transaction.

Categorise your income incorrectly, and you'll pay more in tax.

Activate RBI compliance checks.

Thus, correct usage of Purpose Code P1006 is not only about facilitating hassle-free payments — it's also about safeguarding your business from unwanted regulatory problems.

When Should You Use Purpose Code P1006?

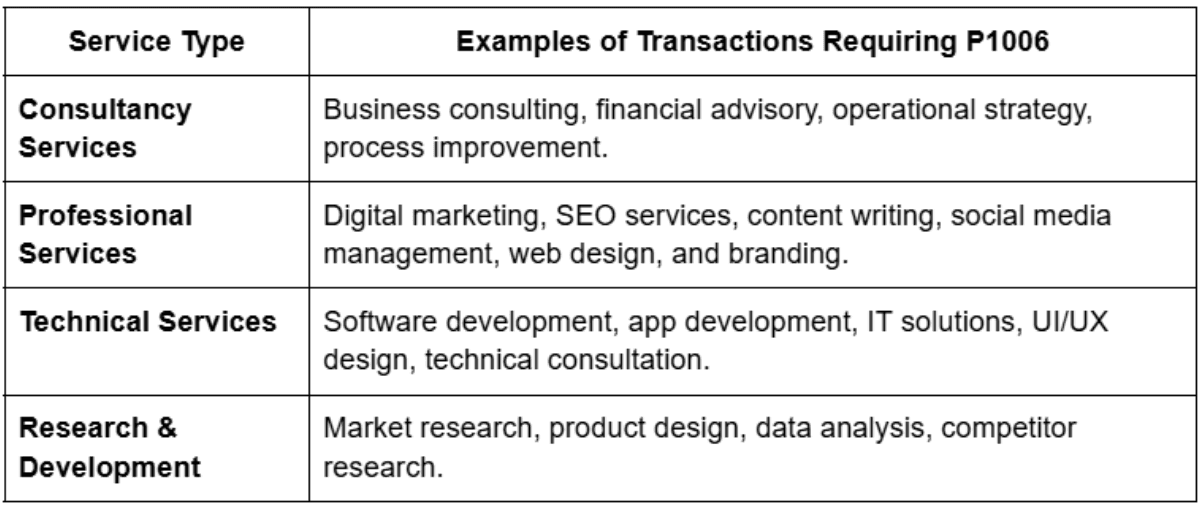

One of the most common misunderstandings exporters have is when precisely to utilise Purpose Code P1006. For easy understanding, here's a direct breakdown:

You Should utilise P1006 purpose code if you supply:

If your business is a service export, you should consistently report your foreign payments under Purpose Code P1006.

What Happens If You Use the Wrong Purpose Code?

Choosing the improper RBI purpose code can result in undue delays, compliance problems, and even additional tax liabilities. Here's why things can go wrong:

1. Delayed Payments

When your bank fails to match your transaction with the proper purpose code, they'll hold back on your payment and ask you for proper documentation or clarification.

2. Increased Tax Liabilities

If you inadvertently report your income under product exports rather than service exports, you could end up paying more taxes. Purpose Code P1006 avoids this problem.

3. Compliance Issues

Incorrect purpose codes initiate compliance checks by the bank or the RBI. You might be required to provide supporting documents to explain the payment.

4. Misreporting of Foreign Income

If you often misclassify your income, your accountant might find it difficult to file export transaction codes in India, which can result in incorrect tax reports.

How to Properly Utilise Purpose Code P1006 and Prevent Delayed Payments

Here is a step-by-step guide to ensure your foreign payments are always smooth:

Step 1: Include Purpose Code P1006 in Your Invoice

While creating your invoice, always include:

Service Description: Specifically mention the service you offered.

Purpose Code: Clearly state "Purpose Code P1006 - Business and Management Consultancy Services."

Example:

Invoice for Web Development and Search Engine Optimization Services for [Client Name].

Purpose Code: P1006 – Business and Management Consultancy Services.

This avoids any bank confusion because it clearly defines the purpose of payment.

Step 2: Inform Your Bank about Purpose Code P1006

When completing the remittance form, always state:

Purpose Code: P1006

Service Description: For instance, "Web Design Services" or "Marketing Consultation."

Invoice or Contract Copy: If requested, submit your invoice to verify the payment purpose.

This step ensures that your payment is correctly categorised under export of services.

Step 3: Verify Purpose Code on Remittance Advice

Once your payment is processed, your bank will issue a Foreign Inward Remittance Certificate (FIRC). Always verify that the purpose code mentioned in the document is:

P1006 - Business and Management Consultancy Services.

If the purpose code is wrong, ask your bank to correct it right away.

Common Mistakes Exporters Make With Purpose Code P1006

Even aware of Purpose Code P1006, most exporters commit these expensive errors:

Error #1: Applying Product-Based Purpose Codes

Certain companies incorrectly apply product export codes such as:

P1011 (Software Imports) in place of P1006.

P0805 (Other Manufacturing Services) in place of P1006.

This tends to lead to delayed payments or tax mismatches.

Error #2: Failure to Include Purpose Code on Invoices

Unless you cite Purpose Code P1006 on your invoice, your payment is likely to be incorrectly classified by your bank and experience delays.

Error #3: Allowing Mistake Purpose Code by Client's Bank

Your client's foreign bank occasionally pays you under the wrong purpose code. Make a habit of confirming the code through the remittance advice.

New RBI and FEMA Notifications regarding Purpose Code P1006 (2025 Version)

As per the Reserve Bank of India's 2025 guidelines, all Indian service exports have to be categorized under:

Purpose Code P1006 – For business, technical, and professional services.

Not using this code can lead to:

Increased tax liabilities.

Delayed payments.

Regulatory non-compliance.

It is advisable that all Indian exporters who are receiving foreign payments under business consultancy services use Purpose Code P1006 strictly.

Conclusion: Avoid Payment Delays With The Right Purpose Code

The P1006 Purpose Code is more than just a formal requirement — it’s the key to receiving international payments without delays.

If you’re an Indian exporter offering business, professional, or technical services, always ensure your bank processes your payments under P1006 purpose code. This will:

Prevent unnecessary compliance checks.

Reduce tax liabilities.

Speed up international payment processing.

Next time you're being paid abroad, double-check your Purpose Code — it may be worth saving weeks of delay.

Sign up with Infinity for receiving smooth, hassle-free international payments.