Global payments

Posted on Mar 3, 2025

Suppose you have just closed an international deal. The money is on its way, and the sender asks for your SWIFT code. You confidently furnish your IFSC code, thinking they're identical.

Days pass—no money, but frustration.

If you’ve ever been in this situation, you’re not alone. Many Indian exporters and business owners assume IFSC and SWIFT codes are interchangeable. The reality? They serve completely different purposes. Let’s break it down in the simplest way possible—no jargon, just straight-up clarity.

What Are IFSC and SWIFT Codes?

Think of your IFSC code as your Aadhaar for Indian banking—it's used only for domestic transactions. SWIFT is your passport for international payments, however, enabling money to move freely across borders.

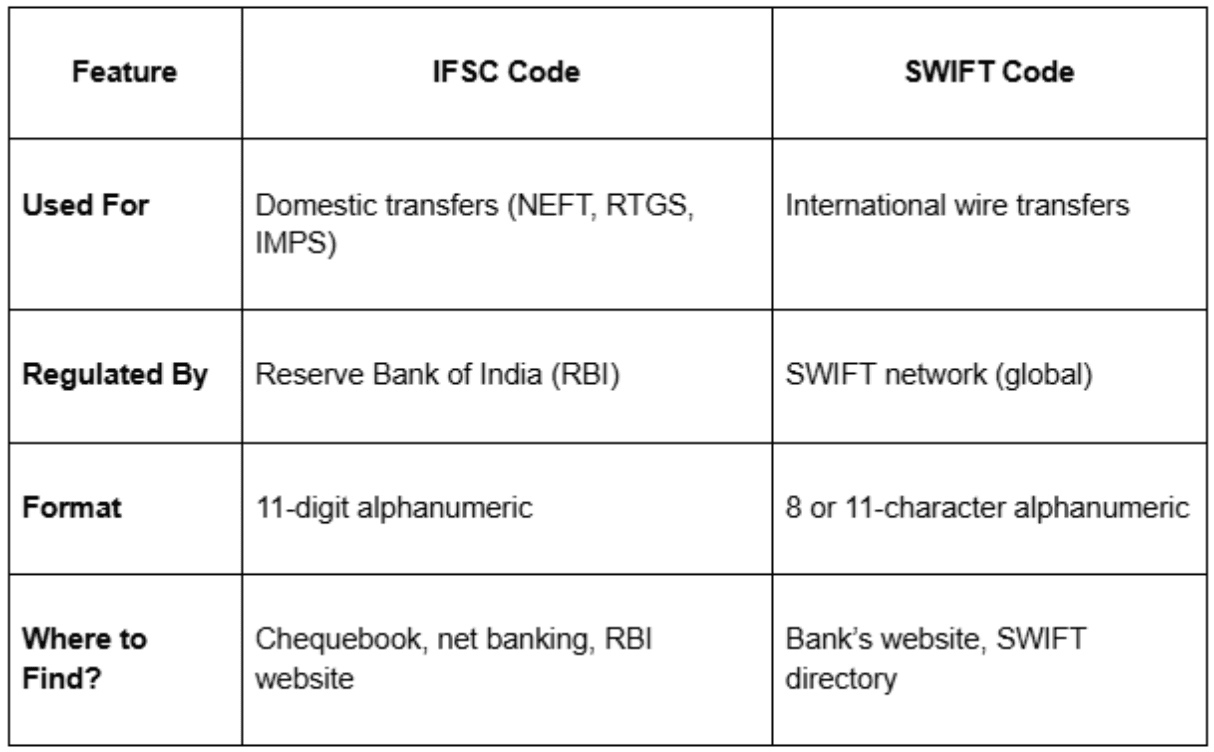

A Quick Breakdown:

IFSC Code (Indian Financial System Code): Used only for Indian transactions (NEFT, RTGS, IMPS). It's regulated by the Reserve Bank of India (RBI).

SWIFT Code (Society for Worldwide Interbank Financial Telecommunication): International wire transfers. Runs on an international network.

If your company works with international clients, it's important to understand the difference. Getting one wrong can result in delayed payments, additional charges, or even misdirected transactions.

Related Read: Understanding Foreign Inward Remittances for Businesses in India

Key Differences Between IFSC and SWIFT Codes

If you're getting an international payment, always verify the SWIFT code with your bank first before sharing it. A small mistake can lead to frustrating delays.

Related Read: How to Receive International Payments in India

Where Do You Get Your IFSC and SWIFT Code?

IFSC Code: On your cheque book, net banking portal, or RBI's official website.

SWIFT Code: On the website of the bank or by calling your branch directly.

Not all Indian bank branches have their own SWIFT codes. If yours doesn't, your bank will utilize a correspondent bank to make the international payments. Always check on this before submitting your details to a client.

External Resource: Find Your Bank's SWIFT Code

Errors to Avoid When Making Use of IFSC and SWIFT Codes

Utilising IFSC for making international payments – IFSC is meant for use in domestic payments only.

Using the wrong SWIFT code – A misplaced keystroke can take weeks from payments.

Not checking correspondent banks – If your bank does not possess its own SWIFT code, make sure to know which bank it is using for international transactions.

Related Read: Cross-Border Payment Errors

Last Words – Leave the Trouble for Infinity to Fix

Nobody likes to wait for payment—particularly for something as insignificant as a coding mix-up. IFSC and SWIFT serve different purposes, and muddling through can be frustrating delays.

With Infinity, that does not occur. We simplify international payments to ensure they are fast, accurate, and hassle-free.

Don't make banking details your headache when you can focus on building your business. Let Infinity handle it.

FAQs – Busting Any Last Confusion!

1. Is IFSC the same as SWIFT for international transactions?

No, IFSC is used for domestic transactions, but SWIFT is required for foreign transfers.

2. Can I use an IFSC code for PayPal or Wise transfers?

No, PayPal and Wise require SWIFT codes, not IFSC.

3. What if my bank doesn't have a SWIFT code?

Your bank will route international transactions through a partner bank that does have a SWIFT code.

4. Does every bank branch have a particular SWIFT code?

No, unique SWIFT codes are available in only large bank branches. The SWIFT of a parent branch is used in small branches.

5. Where can I simply find my IFSC and SWIFT codes?

Consult your chequebook, the bank's site, or RBI's directory for IFSC. For SWIFT, go to the official bank website or discuss it with your branch.